Non-Contributory Plans: Understanding Employee Participation and Employer Obligations

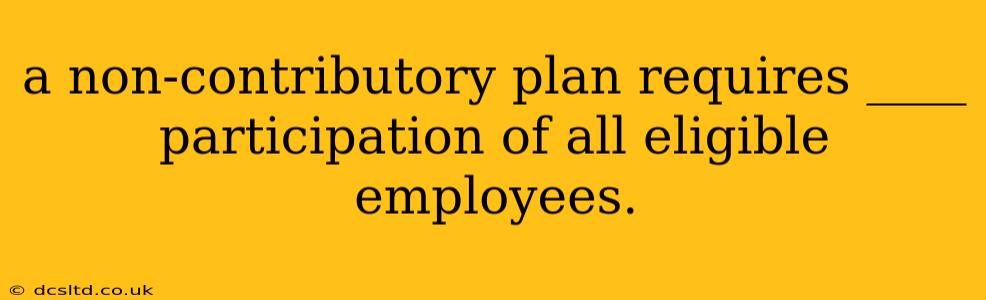

A non-contributory plan requires no participation from eligible employees. The defining characteristic of a non-contributory plan is that the employer pays the entire cost of the plan. Employees don't contribute any of their own money toward benefits like health insurance, retirement, or other perks offered under the plan. This is in contrast to contributory plans, where both the employer and employees share the cost.

What are the advantages of a non-contributory plan for employees?

For employees, the primary benefit is that their compensation isn't reduced by plan contributions. This means they receive their full salary or wages without any deductions for benefits. This can be particularly attractive to employees, improving overall compensation attractiveness and potentially boosting morale. It also simplifies payroll for employees, as there are no deductions to track.

What are the advantages of a non-contributory plan for employers?

From the employer's perspective, a non-contributory plan can be a powerful recruitment and retention tool. Offering a fully-funded benefits package can make a company more competitive in attracting and keeping talented individuals. It can also simplify administrative tasks, as the employer manages the entire plan without needing to track employee contributions.

What are some examples of non-contributory plans?

Non-contributory plans can encompass a variety of benefit types, including:

- Fully employer-funded health insurance: The employer covers the entire premium cost for employee health insurance.

- Employer-sponsored retirement plans: The employer makes the full contribution to an employee's retirement account, such as a defined contribution plan (though the employer doesn't necessarily guarantee a specific return).

- Life insurance: The employer provides a life insurance policy to employees without requiring any employee contribution.

- Disability insurance: The employer pays the premiums for disability insurance to protect employees in case of an injury or illness.

Does a non-contributory plan offer any disadvantages?

While highly attractive to employees, non-contributory plans can be expensive for employers. The entire cost falls solely on the company, which could impact profitability or require other adjustments in the company budget. It's crucial for employers to carefully consider the financial implications before implementing such a plan.

Are there legal requirements surrounding non-contributory plans?

Employers offering non-contributory plans must adhere to relevant laws and regulations, including those pertaining to fair labor practices, discrimination, and tax implications. These regulations can vary depending on the country and region. Seeking expert legal and financial advice is highly recommended before implementing any employee benefits plan.

How does a non-contributory plan differ from a contributory plan?

The key difference lies in the cost-sharing: In a non-contributory plan, the employer bears the entire cost, while in a contributory plan, the cost is shared between the employer and the employee. Contributory plans often offer employees a choice of benefits and contribution levels, allowing for greater personalization.

By understanding the nuances of non-contributory plans, both employers and employees can make informed decisions that align with their financial goals and overall well-being. Remember to always consult with relevant professionals to ensure compliance and optimize the plan's effectiveness.